The Inland Revenue Department (IRD) in Hong Kong is the government agency responsible for administering and collecting taxes. It oversees various tax-related functions, including income tax, property tax, and stamp duty, ensuring compliance with Hong Kong’s tax laws and regulations. The IRD plays a crucial role in maintaining the financial integrity of the territory by managing tax assessments, and collections, and providing taxpayer services.

The responsibilities of the Commissioner of the IRD include overseeing the administration of the following ordinances in Hong Kong:

- Betting Duty Ordinance Cap.108

- Business Registration Ordinance Cap.310

- Estate Duty Ordinance Cap.111

- Hotel Accommodation Tax Ordinance Cap.348

- Inland Revenue Ordinance Cap.112

- Stamp Duty Ordinance Cap.117

- Tax Reserve Certificates Ordinance Cap.289

The Inland Revenue Department (IRD) Hong Kong’s Mission and Vision

The core values of the IRD are professionalism, efficiency, responsiveness, fairness, effectiveness, courtesy, and teamwork. As part of their responsibilities, the IRD has an important part in the promotion of prosperity and stability in Hong Kong. They are committed to the following duties:

- The collection of revenue efficiently and cost-effectively

- The promotion of compliance through its rigorous law enforcement, education, and publicity programmes.

- Providing the taxpaying public with courteous and effective service

- Enabling the IRD staff to obtain the necessary knowledge, attitude, and skills. Upon doing so, they can contribute their best achievement.

Paul Hype Page has been assisting past clients to manage their taxes with the IRD. We have strong relationships with IRD and can provide in-sights on dealing with the IRD, should an individual client require such information.

Inland Revenue Department (IRD) Hong Kong’s eTax Service

The IRD Hong Kong provides a user-friendly electronic service known as eTAX. It offers users an easy, secure and environmentally friendly way to facilitate their compliance with the tax law. As a result, it enables users to carry out their tax obligations with ease and convenience.

Users can log into their eTAX account using their Taxpayer Identification Number (TIN) and their eTAX password to access the services. With the online account, users will then be able to keep track of their current tax position. They can also manage their tax-related affairs and easily communicate with the IRD Hong Kong no matter where they may be and at any time.

Further, the benefits of using the eTAX account include:

- Filing tax returns

- Applying for business registration and also extracts of registration particulars

- Keeping track of outstanding tax returns or payments (if any)

- Updating the personal and business particulars

- Obtain an estimation of Salaries Tax payable

- Making enquiries about personal tax matters

- Applying for provisional tax holdover

- Stamp property documents

- Submitting requests for assessment amendments

- Viewing tax returns which have been filed online. It also tackles tax assessments and payment acknowledgement

Apart from filing taxes individually, one may choose to engage with a professional service firm for additional professional assistance. Paul Hype Page has over 12 years of experience in the Hong Kong financial sector, and we can provide the necessary information one might require when managing taxes.

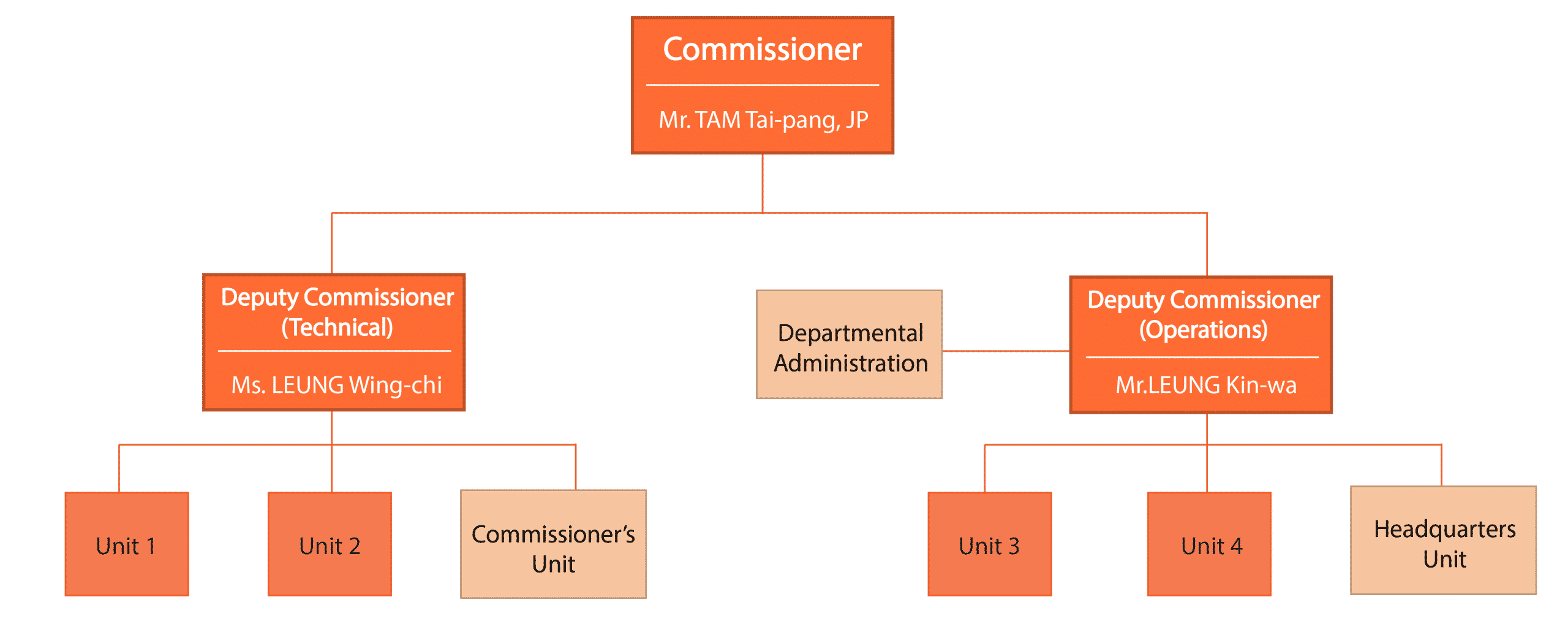

Organization Chart of Inland Revenue Department

IRD Collections

The Department’s revenue collection for 2018-19 was $341.4 billion. This is an increase of $12.8 billion, or 3.9% as compared to the previous year. Of the total revenue collected, Profits Tax and Stamp Duty together contributed 72.2%. The revenue collected by tax type for the latest three years is shown below:

| Type of tax | 2016-17 ($m) |

2017-18 ($m) |

2018-19 ($m) |

|||

| Profits Tax

Corporations Unincorporated Businesses Salaries Tax Property Tax Personal Assessment |

134,031.3 5,206.8

|

139,238.1 59,077.5 3,371.7 5,220.0 |

133,459.3 5,640.9

|

60,838.8 3,447.8 5,342.5 |

160,833.2 5,786.5

|

60,145.9 3,624.4 5,963.1 |

| Total Earnings and Profits Tax | 206,907.3 | 208,729.3 | 236,353.1 | |||

| Estate Duty

Stamp Duty Betting Duty Business Registration Fees |

18.8

61,899.0 21,119.0 227.7 |

31.3

95,172.8 21,959.1 2,726.7 |

88.7

79,978.7 22,194.4 2,826.7 |

|||

| 83,264.5 | 119,889.9 | 105,088.5 | ||||

| Total revenue collected

% change over the previous year |

290,171.8

-0.4% |

328,619.2

+13.2% |

341,441.6

+3.9% |

|||

FAQs

Everyone who receives income in Hong Kong whether through employment or pension is expected by the IRD to pay salaries tax.

Yes, the IRD under the direction of the Commissioner of Inland Revenue will allow you to make an extension to the filing deadline or any other tax deadlines if such an act is deemed suitable.

The Hong Kong government does not charge taxes on the foreign sourced income.