All companies in Hong Kong are required by statutes to carry out the annual filing with the Companies Registry and the Inland Revenue Department. This article is primarily about the annual filing to the Companies Registry. These questions are addressed in the following sub headers:

What is General Compliance and Annual Filing?

In Hong Kong, annual compliance requirements include renewing the company secretary and registered office, auditing the accounts, renewing the business registration, verifying the company’s statutory records, holding an Annual General Meeting, updating company particulars with the Companies Registry, and completing annual filings with the Companies Registry and Inland Revenue Department.

Hong Kong’s Companies Ordinance mandated that all companies must file their Annual Returns with the Companies Registry. This annual filing allows the Companies Registry to ensure that members of the public have access to latest specified information of the company, the company officers and shareholders etc.

The annual filing with the Companies Registry is done via form NAR1 which must be signed by the director, company secretary, manager or authorized representative. This form can be obtained from the Hong Kong Companies Registry website. Additionally, an annual registration fee is due with the annual filing. The amount depends on the company type (local private, local public, limited by guarantee, or non-Hong Kong). Registration fees range from HK$105 to HK$180.

The following information is needed for the annual filing with the Companies Registry:

- Particulars of the company such as company name, business name (if any), registered office address.

- Period covered by financial statements that must be submitted together with this annual filing.

- Liability status i.e., the total amount of indebtedness to which the annual return is made up in mortgages and charges.

- Share capital and particulars of members, if applicable.

- Particulars of the Company Secretary or Secretaries.

- Particulars of directors.

- Company records i.e., register, agreements, minutes, memorandums etc. that are not included in accounting records.

For non-private companies, a certified true copy of the financial statements must be submitted together with the Annual Filing. These documents shall include the report from the directors and auditors.

Annual tax returns must be filed with the Inland Revenue Department every 12 months after the first return. The first tax return must be filed within 18 months of the date of the company’s incorporation. While companies have the freedom to decide on their fiscal year-end date, most companies year-end date will either be 31st December or 31st March to coincide with the government’s fiscal year.

The tax returns consist of audited accounts including company’s balance sheet, auditor’s report, profit & loss account for the accounting period and a tax computation illustrating how the assessable profits or adjustable loss were calculated. Tax forms can be downloaded at the Internal Revenue Department’s website.

When is the Annual Filing required to be submitted?

Except for the first year, the annual filing needs to be submitted within 42 days of the following dates:

- For a private company, the anniversary date of incorporation.

- For a public company, 6 months after the end of the company’s accounting period.

- For a company limited by guarantee, 9 months after the end of the company’s accounting period.

Late annual filings incur a penalty in the form of a higher registration fee, depending on the extent of the delay and the type of company. This can range from HK$870 to HK$4,800. Additionally, if the company fails to comply with the annual filing, every responsible person and/or agent who authorized the default can be prosecuted. The maximum penalty for each breach is HK$50,000, and a daily default fine of HK$1,000 can be imposed for continuing offenses.

How is the Annual Filing submitted?

The Companies Registry annual filing bi-lingual form NAR1 must be completed in either English or Chinese and the form must be signed (or digital signature affixed for e-submission) by the Director or Company Secretary.

Forms that are not properly signed or not accompanied with the correct registration fee will be rejected by the Companies Registry. The re-submission date will be used to calculate the annual registration fee which may result in higher fee payable requirement.

Submission of the annual filing is to be accompanied by the registration fee. For hard copy submissions, cheques in Hong Kong Dollars should be crossed and issued to “Companies Registry”. Electronic filing uses various on-line payment methods i.e., deduction from e-Registry deposit account, credit card, digital wallet and PPS Shop & Buy Service.

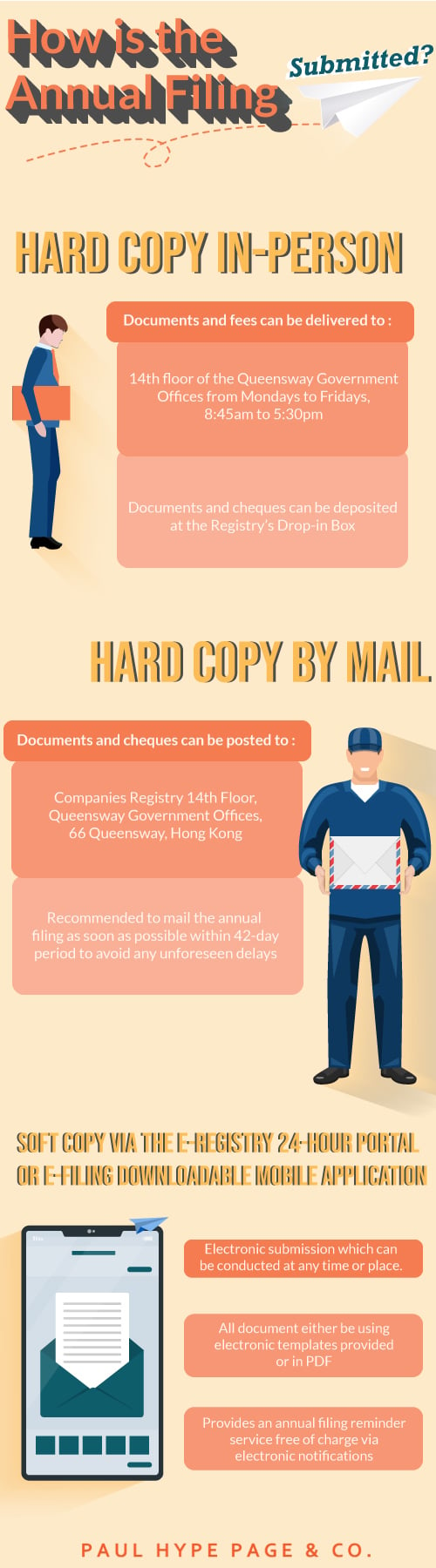

The annual filing of documents and the registration fee can be submitted via the following methods:

-

Hard Copy In-Person

Documents and fees can be delivered to the counters at the 14th floor of the Queensway Government Offices from Mondays to Fridays, 8:45am to 5:30pm.

Outside of these hours (except for Public Holidays), the documents and cheques can be deposited at the Registry’s Drop-in Box located near the Information Counter on the Deck Floor, High Block of the Queensway Government Offices. -

Hard Copy By Mail

Documents and cheques can be posted to:

Companies Registry 14th Floor, Queensway Government Offices, 66 Queensway, Hong Kong.

For the purpose of calculating the annual registration fee (see section above ‘When is the Annual Filing required to be submitted to the Companies Registry?’), the date appearing on the mail’s post mark will be used.

However, the annual filing will not be regarded as submitted to the Companies Registry if it’s not received by the Registrar within the stated time period. Therefore, it is recommended to mail the annual filing as soon as possible before the deadline to avoid any unforeseen delays. -

Soft copy via the e-Registry 24-Hour Portal or E-Filing Downloadable Mobile Application

The Companies Registry developed the e-Registry to facilitate electronic submission which can be conducted at any time or place. The e-Registry allows users to deliver the annual filing even when the Companies Registry is closed. An example of this situation will be if the 42nd day falls on a Saturday. Annual filing can be carried out after registration at the portal website. Along with that, the authorised person’s digital signature or password shall be affixed to the submitted documents. All submitted documents shall either be using the electronic templates provided or in Adobe Portable Document Format (PDF).

The e-Registry also provides an annual filing reminder service free of charge via electronic notifications. The electronic notification will have hyperlinks to relevant forms such as the e-form version of the NAR1 form.

E-Filing is a mobile application that can be downloaded from Apple Store or Google Play.

In a Nutshell

The annual filing to the Companies Registry is to ensure that the company is in general compliant to Hong Kong’s Companies Ordinance and to ensure that the company’s information is updated and available to the public.

The annual filing process is simple and there are many avenues to submit the annual filing in a timely manner.

To avoid breaching regulations, companies should submit their annual filing as early as possible within the required time period. This is to avoid prosecution resulting in financial penalties. In the worst case, the Registrar of Companies may consider striking-off the company. That will mean the company will be unable to operate its business.

FAQs

Yes, it is the duty of the officers of the company to understand and comply with all the regulations of the Companies Ordinance.

No, changes of the company particulars shall be reported in separate appropriate forms which have their own due dates. The company particulars and its officers reported in the annual filing shall be correct as of date of filing.

Yes, every company registered with the Companies Registry is required to do the annual filing by its respective due date. Only companies which have been declared dormant to the Companies Registry are exempted from the annual filing though annual business registration is still required. Do note that annual filing is still required if the dormant declaration date is after the 42nd day of the anniversary of the company’s incorporation.

Yes, Sundays and Public Holidays are included. If the 42nd day is a Sunday or Public Holiday, then the due date is extended to the following day (provided the extended day is neither a Sunday nor a Public Holiday). The due date remains unchanged if the 42nd day is a Saturday.