Why Different Business Structures are Necessary

Business is an integral part of a modern society. Business can be defined as an organized or systematic activity for the earning of profit. It is also concerned with the activities of people working towards achieving a common economic goal. It is an imperative part of human societies. Its purpose is to satisfy individual wants by providing varieties of goods and services.

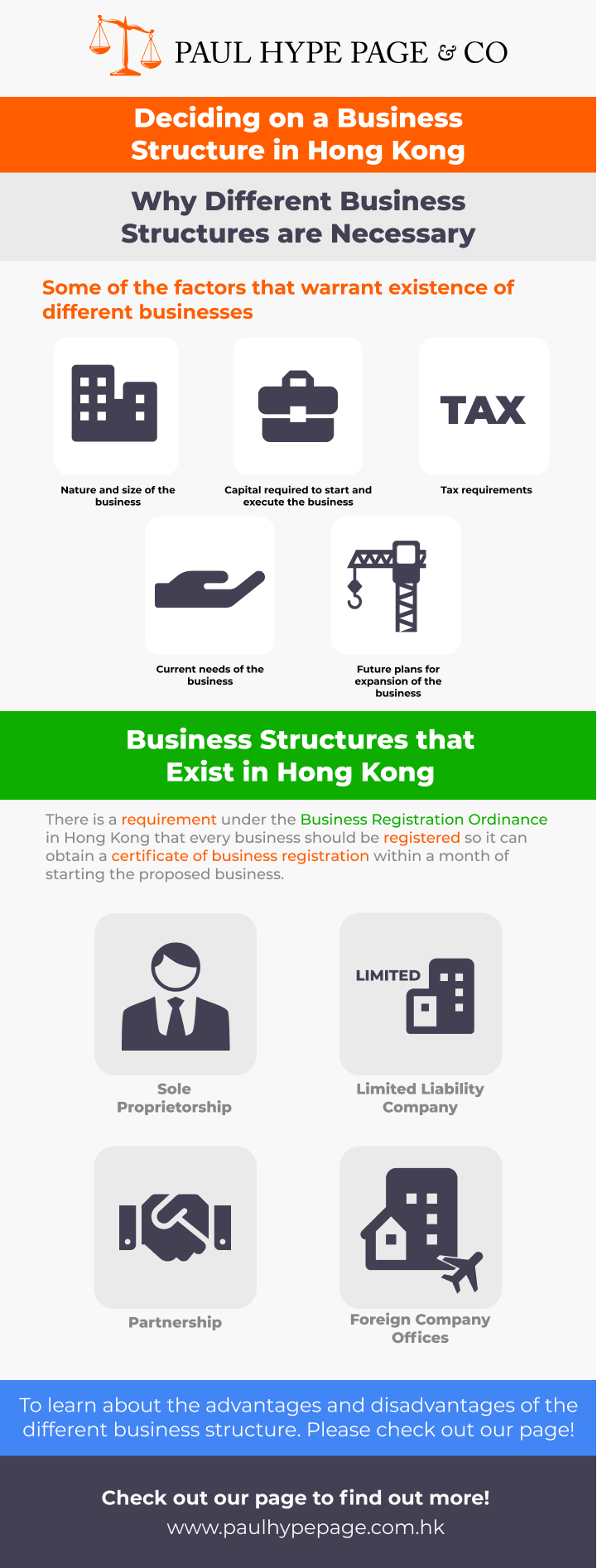

A business organization is an entity that is both commercial and social in nature. It provides necessary structures to achieve the central objectives of trades in goods and services. Different business structures exist because of the varying natures of different businesses. Some of the factors that warrant existence of different businesses include the following:

- Nature and size of the business

- Capital required to start and execute the business

- Tax requirements

- Current needs of the business

- Future plans for expansion of the business

Hence, different business structures exist so as to fit individual needs. It is particularly important to examine the peculiarities of each of these business structures so as to determine which one will suit all requirements and also the budget needed.

A considerable amount of time should be spent on researching each of the business entities in which their pros and cons should be understood. Certain questions should be asked about whether the requirements meet the need of your business. Other matters that should be considered include:

- Level of control over the business

- Liabilities that will accompany your choice of the business

- Time frame required in starting and the cost of executing the business

Business Structures that Exist in Hong Kong

The economy of Hong Kong is the ninth-largest in the world. It offers an enabling environment for investors around the world to ply their trade conveniently. Establishing a business venture in Hong Kong can be an excellent decision for any business owner. However, business owners also ought to know what kind of business entity is advisable for them to set up in Hong Kong?

There exist a few kinds of business entities that can be set up in Hong Kong, and selecting the proper one to accommodate the business structure is a significant element of the procedure. One should invest a lot of energy in cautiously gauging the advantages and disadvantages of every business structure. Questions to be asked should include whether the structure is going to meet your objectives, as well as whether it will address the issues and necessities for business purposes.

There is a requirement under the Business Registration Ordinance in Hong Kong that every business should be registered so it can obtain a certificate of business registration within a month of starting the proposed business. The principal office address is required, as well as other business addresses. This is necessary to make it known to the Hong Kong Inland Revenue Department about the business in Hong Kong which is subject to profit tax. Also, a business registration certificate is required for a company that has one or more business names.

The following are the type of business entities that exist in Hong Kong:

- Sole Proprietorship

- Limited Liability Company

- Partnership

- Foreign Company Offices

– Subsidiary Company

– Branch Office of Foreign Company

– Representative Office (Liaison Office)

Sole Proprietorship

This form of business is appropriate for small scale organizations as well as organizations which have lower risk involvements. As the name implies, this business includes just a solitary proprietor and thus, it is a simple business entity to set up in Hong Kong. In any case, the risks required include the fact that sole ownerships are not viewed as isolated lawful substances, which means the owner’s own advantages are an obligation since they are connected to the business.

The sole proprietorship is the simplest form of business in which an individual can operate a business. It is a business structure in which one person owns the business and is personally responsible for its debts. It is the simplest form of business. A sole proprietor is someone that owns an unincorporated business. Factors that are driving forces for people to select a sole proprietorship in include a desire for status, distrust of others, and independence. An owner of a sole proprietorship subscribes to all equity of capital of the business.

Advantages of a Sole Proprietorship

- Simplistic structure

- Easy to set up; no registration needed; just business license and permits.

- Does not require legal recognition or attendant formalities

- No distinction between business and proprietor, even after registration

- No separation between proprietor and management

- Proprietor receives all the profits earned

- Process of decision-making is easier and independent

- Compared with other forms of business, the sole proprietor usually has tax advantagse; the sole proprietor is taxed less than owners of other business structures

- Relatively easy to end due to the lack of co-owners; this implies that the owner need not consult anyone to end the business

Disadvantages of a Sole Proprietorship

- Subject to legal scrutiny

- Constrained capital

- Owner has unlimited personal liability, meaning that the owner suffers the loss alone and the owner’s personal belongings can be used to settle the loss

- Limited lifespan due to the fact that death or infirmities of the owner result in the end of the business

- Low levels public recognition

Limited Liability Company

A limited liability company is a legal entity which is separate from its owners. Thus, it is a separate legal entity. It can sign a contract, sue, and be sued. It can affiliate with other companies and open subsidiaries. The company is officially and legally formed after meeting the stipulated conditions according to Company Ordinance. This structure is the most widely recognized business structure set up in Hong Kong. Organizations are consolidated as limited liability companies. The benefits of the entrepreneur are shielded from risks since this business is viewed as a separate legal entity. This business can be registered with the Companies Registry under the Companies Ordinance in Hong Kong. These companies are limited by shares and guarantees.

This business structure can either be a privately owned business (Private Limited Company) or a publicly owned business (Public Limited Company).

Private limited companies are the most common type of business structure in Hong Kong as they are limited by shares and have share capital usually distributed to a number of shares of a certain value. Also, the shareholders hold the shares, and are also entitled to the business profits. Corresponding dividends are made based on the percentage of shareholding of investors in the company. If there are any losses, shareholders lose their investments based on the amount of shares they have invested in the company.

Public limited companies, on the other hand, have their shares and debentures offered to the public. In Hong Kong, most limited liability companies start as private companies, then become public after achieving substantial growth. They achieve this by expanding their shareholder base. These companies are then placed on the public stock exchange under stringent rules and regulations.

Advantages of a Limited Liability Company

- Separate legal entity which is not affected by a change in ownership; it bears its own identity which is separate from that of its members.

- Can acquire assets, enter into contracts, affiliate with other companies, sue, and be sued; each shareholder is only accountable to receive shares from their investments.

- Has perpetual succession and does not cease to exist upon a change in ownership or membership; except during the expiration, resignation, or death of the shareholders, there will not be any effect on the business operation

- Ease in transfer of ownership; shares can be transferred or even sold, allowing business operations to continue

- Benefits of tax and other incentives

Disadvantages of a Limited Liability Company

- Difficult to establish

- Difficult to wind up compared to other business structures

- Certain obligations must be complied with

How to Register a Private Limited Company with the Company Registry

The following list of documents must be provided to register a private limited company:

- One copy of articles of incorporation

- Incorporation form that bears the following details:

-Company’s name

-Registered address

-Description of business activities

-Details of members, shareholders, share capital, and share types

- Copies of documents carrying founder’s identification

Any company to be registered in Hong Kong must bear a unique name; this is ensured by doing a name check prior to registering the proposed name. A company is also required to have a Hong Kong bank account, stamp, seal, share register, share certificate, and statutory books.

Partnership

A partnership is an arrangement in which partners agree to cooperate to advance their mutual interest. It is a legal relationship between two or more persons in which each person invests money in order to carry out a lawful business with a view to earning profits. This profit will then be shared based on a mutual agreement between the partners. The income the partnership earns is then duly reported. It is important to note that in a partnership, partners report their share of partnership income on their personal tax returns and pay any tax owned. This business structure allows at least two individuals to share the responsibility of a business. The share format of this structure permits the people included to have a more prominent capacity to raise the funds needed to begin this business. In Hong Kong, limited partnerships are the most common partnership because they offer restricted risk to the partners.

A partnership agreement may either be in written or unwritten form. The written form is advisable; it will reduce possibilities of misunderstanding and disagreement. The partnership agreement establishes a legal relationship between the partners although a partnership is not a legal entity.

There exist two forms of partnership; the general partnership and limited partnership. The two choices have their own advantages and disadvantages.

In a general partnership, the partners are liable for the partnership’s debt. It can be established with ease, and the business can be grown by the experience brought by each of the partners.

In a limited partnership, all members are not liable for the business debts; the liability is dependent on the joint amount of capital invested into the business. Hence, the partnership cannot be managed by the limited partners.

Advantages of a Partnership

- Easy to form; they are inexpensive business structures

- Offers employment opportunities

- Shared financial commitments: since each partner invests in the success of the business, partners pool resources together to grow the business

- Complimentary skills: partners contribute their various skills to help the partnership succeed

Disadvantages of Partnership:

- There could be possibility of disagreement between partners, which may hamper the goal of the business

- Decisions a partner makes and debts of the business are liabilities of the other partner

- Assets of all partners can be used to settle the debt of the partnership; hence, the partners risk all their assets, even those not invested into the business, since the partners are accountable for business debts

- Each partner must share profits and success of the business

- Problems and conflicts may arise if there is unequal contribution of resources, time, and effort

- In most cases, death of a partner can lead to the dissolution of the partnership

Foreign Company Offices

Investors and business visionaries who officially claim organizations of their own, yet are planning to set up a base in Hong Kong, have the choice of doing so by enlisting as a branch office. In this business structure, the workplace is seen as a representative or a subsidiary office.

Subsidiary Company

This company is a private limited company that is incorporated is Hong Kong. The establishment is considered an asset of the parent foreign company. Since it is a separate legal entity from the parent company, it is liable for its own debts. It is preferred to a branch office because the time taken to incorporate a Hong Kong subsidiary is less than the time spent to register a branch office.

Branch Office of Foreign Company

Since the same tax rates apply for both local and foreign companies, business activities in Hong Kong do not depend on whether a company is incorporated locally or is a branch of a foreign company. As the name implies, a branch company is an extension of a parent company and is not a separate legal entity. Debts and liabilities are therefore incurred by the parent company. A branch company also bears the same tax and legal obligations as an incorporated company in Hong Kong.

The requirement for a foreign company to establish a branch company in Hong Kong is to register as a non-Hong Kong Company with the Hong Kong Company Registry. Therefore, the branch must comply with the provisions of the Ordinance.

The operations of the branch company can easily be terminated by informing the Registry that its business activities have ended in the country.

Representative Office

Just like a branch office, parent companies are fully responsible for the liabilities and debts of representative offices, but unlike branch offices, representative offices do not require registration with the Hong Kong Companies Registry, although a business registration certificate must be acquired under the Business Registration Ordinance.

Also, negotiations and contractual activities cannot be executed by the representative offices. These functions such as trading activities, signing of deals, and negotiations can only be performed by the parent companies. For these reasons, a representative office cannot carry out

any business activities in Hong Kong and cannot generate tax profits to Hong Kong Inland revenue department. Therefore, the representative office must apply for an exemption from profit tax since it does not carry out any business activities.

The business environment considerably influences the business structure to be selected. Hence, business owners should understand their environment and have appropriate knowledge of the pros and cons of each business structure so as to have corporate growth, as poor planning often leads to business failure.